A statute of limitations on debt is the time frame a creditor or debt collector has to sue you to aim to get you to pay. Tips differ by state, with many having statutes of limitations ranging from three to six years, nevertheless some states allowing 10 years to cross sooner than collectors lose their correct to licensed movement.

The courtroom system wouldn’t protect observe of the statute in your debt. As a substitute, it’s your obligation to indicate the debt has handed its statute of limitations.

- A statute of limitations on debt is the time frame a creditor or debt collector has to sue you to aim to get you to pay.

- A number of kinds of cash owed might need fully completely different statutes of limitations; e.g., an overdue financial institution card bill might need a definite time limit than a delinquent promissory discover value.

- Each state has its private authorized tips about statutes of limitations.

- As quickly as a judgment is entered, it may have its private, longer statute of limitations, and it’d have the ability to be extended.

Time-Barred Cash owed

The statute of limitations typically begins when you miss a value. Cash owed which have handed the statute of limitations are known as time-barred cash owed. Nonetheless,?just because the cash owed have aged earlier the statute of limitations doesn’t indicate that you just not owe money or that your credit score standing cannot be impacted. It merely means the creditor is not going to get a judgment in opposition to you.

If one does try to sue you, you’ll have to let the courtroom know that the statute of limitations has run out, and provide some proof. Proof may embrace a personal study or monetary establishment assertion displaying the ultimate time you made a value, or your particular person info of communication?that you’ve made about that debt.

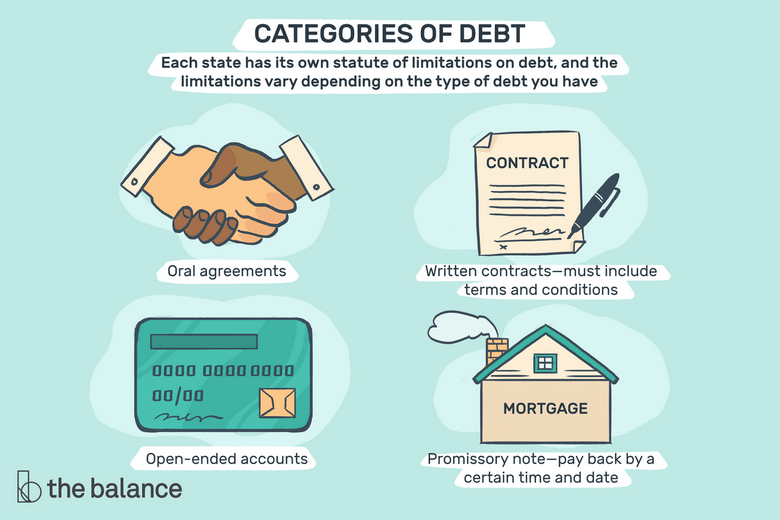

Lessons of Debt

Cash owed fall into fully completely different lessons. It’s vital to know which kind of debt you can have because of the deadlines are generally fully completely different for each variety. Beneath are 4 most vital varieties, nevertheless some states have rather more lessons, comparable to auto loans, which might have separate statutes of limitations.

- Oral agreements: These are cash owed that had been made based totally on a verbal settlement about reimbursement, and there is nothing in writing.

- Written contracts: All cash owed that embrace a contract that was signed by you and the creditor fall throughout the class of a written contract¡ªeven when it was written on a napkin. Often a written contract consists of the?phrases and circumstances of the mortgage, such as a result of the mortgage amount and month-to-month value.

Nonetheless not always. For instance, medical funds may be thought-about a written contract, even when no reimbursement phrases are included and the bill itself wouldn’t comprise any signatures.

- Promissory notes: A promissory discover is a written settlement to pay once more a debt in a positive number of funds, at a positive fee of curiosity, and by a positive date and time. Dwelling loans and scholar loans are two examples of promissory notes.

- Open-ended credit score rating: A revolving account you’ll repay after which borrow in opposition to as soon as extra is open-ended. Financial institution playing cards, in-store credit score rating, and contours of credit score rating?are all examples of open-ended accounts.

Remember

For many who’re uncertain about what sort of debt you can have or whether or not or not it’s time-barred, it is doable you may want to look at with a nonprofit credit score rating counseling firm. A credit score rating counselor can help you establish the best option to cope with your debt. You may also want to look at with a lawyer.

Statutes of Limitations for Each State

Each state has its private statute of limitations on debt, and they also differ counting on the form of debt you can have. Usually, it is between three and 6 years, nevertheless it could be as extreme as 10 or 15 years in some states. Sooner than you reply to a debt assortment, uncover out the debt statute of limitations to your state.

If the statute of limitations has handed,?there may be a lot much less incentive as a way to pay the debt. If the credit score rating reporting time limit moreover has handed, it is doable you may be even a lot much less inclined to pay the debt. The credit score rating reporting time limit is how prolonged a debt reveals up in your credit score rating report. It is neutral of the licensed statute of limitations.

Beneath are the statutes of limitation, measured by years, in each state, as of 2022. Remember that in some states, financial institution card agreements are thought-about written contracts; nevertheless in others, courts have talked about they’re oral contracts because of card issuers can change the settlement with out consent from the borrower.

| State | Oral | Written | Promissory | Open |

|---|---|---|---|---|

| Alabama | 6 | 6 | 6 | 3 |

| Alaska | 3 | 3 | 3 | 3 |

| Arizona | 3 | 6 | 6 | 6 |

| Arkansas | 3 | 5 | 5 | 5 |

| California | 2 | 4 | 4 | 4 |

| Colorado | 6 | 6 | 6 | 6 |

| Connecticut | 3 | 6 | 6 | 6 |

| Delaware | 3 | 3 | 3 | 3 |

| Florida | 4 | 5 | 5 | 5 |

| Georgia | 4 | 6 | 6 | 6* |

| Hawaii | 6 | 6 | 6 | 6 |

| Idaho | 4 | 5 | 5 | 4 |

| Illinois | 5 | 10 | 10 | 5** |

| Indiana | 6 | 6 | 10 | 6 |

| Iowa | 5 | 10 | 10 | 5 |

| Kansas | 3 | 5 | 5 | 3 |

| Kentucky | 5 | 10*** | 15 | 10*** |

| Louisiana | 10 | 10 | 10 | 3 |

| Maine | 6 | 6 | 20 | 6 |

| Maryland | 3 | 3 | 6 | 3 |

| Massachusetts | 6 | 6 | 6 | 6 |

| Michigan | 6 | 6 | 6 | 6 |

| Minnesota | 6 | 6 | 6 | 6 |

| Mississippi | 3 | 3 | 3 | 3 |

| Missouri | 5 | 10 | 10 | 5 |

| Montana | 5 | 8 | 8 | 5 |

| Nebraska | 4 | 5 | 5 | 4 |

| Nevada | 4 | 6 | 3 | 4 |

| New Hampshire | 3 | 3 | 6 | 3 |

| New Jersey | 6 | 6 | 6 | 6 |

| New Mexico | 4 | 6 | 6 | 4 |

| New York | 6 | 6 | 6 | 6 |

| North Carolina | 3 | 3 | 3 | 3 |

| North Dakota | 6 | 6 | 6 | 6 |

| Ohio | 6 | 6 | 6 | 6 |

| Oklahoma | 3 | 5 | 6 | 3 |

| Oregon | 6 | 6 | 6 | 6 |

| Pennsylvania | 4 | 4 | 4 | 4 |

| Rhode Island | 10 | 10 | 10 | 10 |

| South Carolina | 3 | 3 | 3 | 3 |

| South Dakota | 6 | 6 | 6 | 6 |

| Tennessee | 6 | 6 | 6 | 6 |

| Texas | 4 | 4 | 4 | 4 |

| Utah | 4 | 6 | 6 | 4 |

| Vermont | 6 | 6 | 6**** | 6 |

| Virginia | 3 | 5 | 6 | 3 |

| Washington | 3 | 6 | 6 | 6 |

| West Virginia | 5 | 10 | 6 | 5 |

| Wisconsin | 6 | 6 | 10 | 6 |

| Wyoming | 8 | 10 | 10 | 8 |

*Georgia appeals courtroom circumstances have found that financial institution card debt is subject to a six-year interval for contracts.

**In Illinois, financial institution card agreements are thought-about written contracts with a 10-year statute of limitations. Nonetheless, the state appeals courtroom dominated in 2011 that the debt collector ought to current the defendant’s specific particular person financial institution card settlement, not a generic settlement. If they can not, the five-year statute of limitations for unwritten contracts applies.

***In Kentucky, collectors have 10 years to pay debt recorded in a written contract signed after July 15, 2014, along with a financial institution card utility, vehicle mortgage, or medical treatment paperwork that you just signed.

****In Vermont, the statute of limitations for a witnessed promissory discover is 14 years, however when the signature is not going to be witnessed, it’s six years.

Warning

The data proper right here refers again to the time any person has to file a lawsuit. As quickly as a judgment is entered, there’s usually a separate statute of limitations for amassing on the debt. It varies by state, nevertheless it is typically longer¡ªat the very least 10 years¡ªand usually it could be renewed, which means it could probably closing even longer.?

Incessantly Requested Questions (FAQs)

When does the statute of limitations on debt begin?

The clock typically begins on the ultimate day you had any train on the account. Train may embrace making a value, establishing a value affiliation, or simply acknowledging obligation for the debt.

What can restart the debt statute of limitations?

Any new train in your account can restart the statute of limitations to your debt. For many who make a model new value on the account, prepare a value, enter an settlement, or conduct another train, the clock could start over.

Why are there statutes of limitations?

Statutes of limitations are supposed to place a time limit on collectors or debt collectors which is able to search to take licensed movement to collect a debt. If a debt passes the time limit, the creditor cannot file a lawsuit in opposition to the debtor. This protects debtors from perpetually being uncovered to obligation for outdated cash owed.