Debt collectors work on behalf of lenders. Since you’re in a roundabout way concerned with the sale or task of your debt to a group company, you will not at all times know which assortment company has your debt.

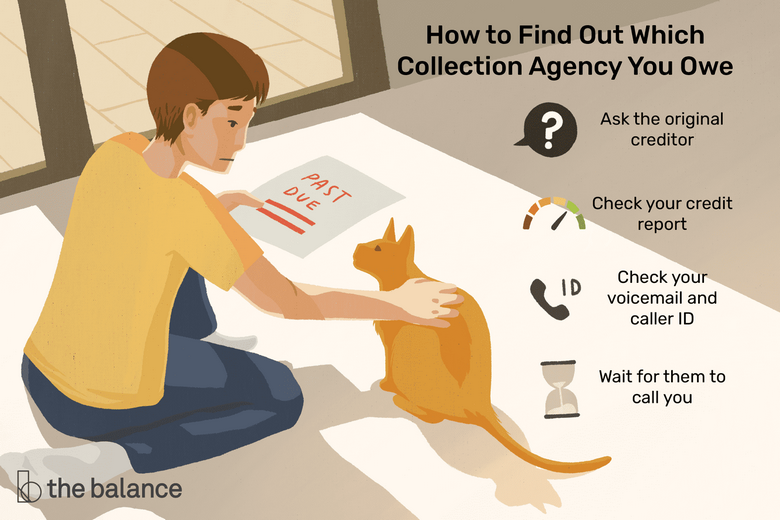

Debt collectors sometimes announce themselves by contacting you thru telephone calls, letters, or different means. Nonetheless, when you could have an account in collections however do not know which company has the debt, there are 4 methods you could find out.

Asking the Unique Lender

The lender you initially had the account with might be able to inform you which assortment company bought or in any other case acquired your account. Nonetheless, it is also doable the account has been transferred to a 3rd company, and in that case, your unique lender is unlikely to be of help.

Notice

Earlier than paying, ask the debt collector to ship proof of the debt within the type of a written debt validation letter.

It is also doable the unique lender is not going to settle for fee from you and even talk about the account with you. As soon as a lender sells a debt, there’s typically little or no they will do to settle the account. To make a fee, you will probably must contact the gathering company to seek out out what you owe and how you can pay the steadiness.

Checking Your Credit score Report

Most assortment businesses report money owed to the credit score bureaus, so chances are you’ll discover the title and telephone quantity you want on a latest copy of your credit score report. Collections which are model new or which are greater than seven years outdated may not present up in your credit score report.

There¡¯s no technique to know whether or not a specific assortment company?reported your debt to 1 credit score bureau or all three, so it might be essential to test your credit score stories with every of the most important credit score bureaus: Equifax, Experian, and TransUnion.

Checking Your Voicemail and Caller ID

Reliable debt collectors will go away a voicemail and phone info if they can’t attain you immediately on the telephone. You can also find a group company with simply the telephone quantity out of your caller ID or voicemail by typing the quantity right into a search engine. The search end result might comprise outcomes from web sites the place different folks have shared details about who known as from that quantity and the character of the decision.

Notice

Watch out about calling debt collectors with out first getting ready. Count on the collector to try to gather fee from you as soon as they get you on the telephone.

Some assortment businesses deal with solely particular sorts of debt, reminiscent of medical debt or past-due cable payments. Looking out the telephone variety of the gathering company will help you determine whom you owe cash to and why.

Ready for Them To Name You

If you’re unable to seek out the data your self, typically the most effective factor to do is to attend for the collector to contact you by telephone or letter. The company that holds the debt finally will get round to contacting you as a way to get the cash it’s owed.

Whereas awaiting the inevitable telephone name, it is necessary to pay attention to your rights. A collector who calls you should be prepared to offer you the title of the creditor and the quantity owed, and inform you that you’ve got the appropriate to dispute the debt.

Negotiating With a Assortment Company

Upon getting decided who’s making an attempt to gather in your debt, you must have a plan for settling the account. If the collector has bought the debt from the unique lender, it is necessary to know that it probably did so for less than pennies on the greenback. For instance, it isn’t unusual for a debt purchaser to buy a $10,000 debt for lower than $1,000. The unique lender will get some cash that manner, and the brand new proprietor of the debt could make a revenue for something it collects in extra of the acquisition value.

Notice

Seek the advice of with an legal professional if in case you have any questions or issues a couple of debt you are attempting to settle. Statutes of limitations and different laws range from jurisdiction to jurisdiction, and authorized recommendation particular to your state of affairs can prevent some huge cash.

Many collectors will settle for lower than the steadiness owed as a way to settle the account. Nonetheless, earlier than paying any cash towards such a settlement, it is necessary to require the collector to offer the phrases of the deal in writing. Failing to take action signifies that the collector can proceed to come back after you for cash, no matter what somebody might have stated over the telephone.

Steadily Requested Questions (FAQs)

How do you determine whether or not a debt collector is reputable?

If somebody reaches out and claims to be a debt collector, ask for as a lot element as you’ll be able to concerning the assortment company, together with telephone numbers, road addresses, and license numbers when you reside in a state that licenses assortment businesses. Test that info along with your Secretary of State’s workplace or every other state regulatory authority that tracks these companies.

What occurs when you do not pay a group company?

Ignoring debt will be detrimental to your credit score rating, and the gathering company can sue to garnish wages or seize belongings in lieu of debt fee. That, in flip, impacts your capacity to entry monetary merchandise, and when you’re provided a mortgage or line of credit score, it would probably include a high-interest fee. Very bad credit scores might also have an effect on the best way potential employers view your utility.

How lengthy do you could have earlier than a group company stories to credit score bureaus?

Debt collectors can report your info to credit score bureaus after following sure guidelines for informing you concerning the debt. In case your debt has been handed over to a group company, and the company has contacted you personally or despatched you a validation discover, it is best to anticipate that info to be reported virtually instantly. Grace intervals are sometimes reserved for these with an in any other case good credit score historical past, reminiscent of somebody who missed a single fee and settled it inside just a few days.