The Trustworthy Credit score rating Reporting Act offers buyers the right to dispute errors on their credit score rating report, nonetheless what about when the unfavourable data is appropriate? You could should take a definite methodology. Requesting a pay for delete may help you to clear up credit score rating errors and start enhancing your credit score rating score.

What Is Pay for Delete?

Pay for delete is a negotiation method it’s best to use to have?unfavourable data eradicated out of your credit score rating report. The pay for delete letter is sweet for cash owed that will’t be disputed with the credit score rating bureaus because you actually owe them.

This can be a sample pay for delete?letter it’s best to use to request a creditor take away an account out of your credit score rating report in alternate for value.

Observe

To request a paid account be eradicated out of your credit score rating report, use a goodwill deletion request letter in its place.?

Sample Pay for Delete Letter

This can be a sample pay for delete letter will be utilized to cleanup your credit score rating report. Change?the daring devices alongside together with your specific, non-public account data. It’s going to even be helpful to reword the letter to make it specific to your state of affairs. Receive the letter template (appropriate with Google Docs and Phrase), or retype the textual content material below into the software program program of your various.

Receive the Phrase Template

Sample Pay for Delete Letter (Textual content material Mannequin)

Your Title

Your Deal with Your Metropolis, State Zip

Collector¡¯s Title

Collector¡¯s Deal with

Collector¡¯s Metropolis, State Zip

Date

Re: Account Amount XXXX-XXXX-XXXX-XXXX

Dear Assortment Supervisor:

This letter is in response to your [letter / call / credit report entry] on [date] related to the debt referenced above. I wish to save us every some time and effort by settling this debt.

Please do not forget that this is not an acknowledgment or acceptance of the debt, as I’ve not acquired any verification of the debt. Neither is that this a promise to pay and is not a price settlement besides you current a response as detailed below.

I am aware that your group has the pliability to report this debt to the credit score rating bureaus as you deem important. Furthermore, you may need the pliability to change the itemizing because you’re the data furnisher.

I am eager to pay [this debt in full / $XXX as settlement for this debt] in return in your settlement to remove all data regarding this debt from the credit score rating reporting companies inside ten calendar days of value. Once you adjust to the phrases, I will ship licensed value throughout the amount of $XXX payable to [Collection Agency] in alternate to have all data related to this debt far from all of my credit score rating recordsdata.

Once you accept this present, you moreover conform to not concentrate on the present with any third event, excluding the distinctive creditor. Once you accept the present, please put collectively a letter in your agency letterhead agreeing to the phrases. This letter must be signed by a licensed agent of [Collection Agency]. The letter will seemingly be dealt with as a contract and matter to the authorized pointers of my state.

As granted by the Trustworthy Debt Assortment Practices Act, I’ve the right to dispute this alleged debt. If I do not receive your postmarked response inside 15 days, I will withdraw the present and request full verification of this debt.

Please forward your settlement to the cope with listed above.

Sincerely,

Your Title

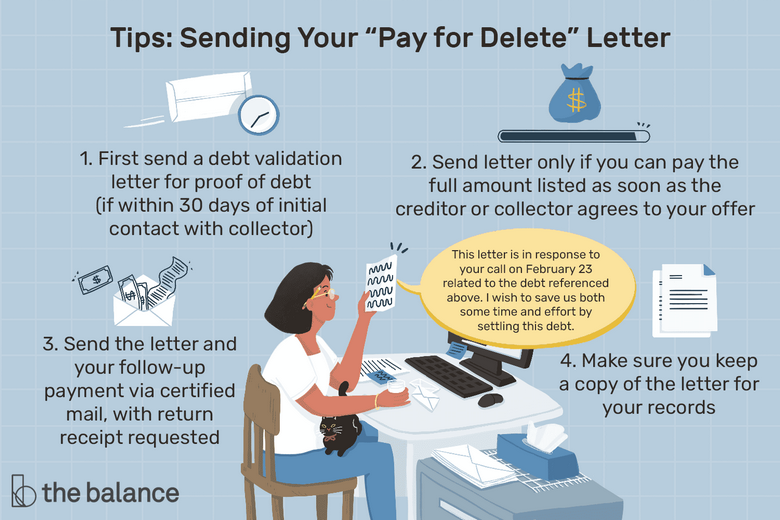

Concepts for Sending Your Pay for Delete Letter

- Sooner than you make a pay for delete present on?a set account, make sure it’s your debt and the debt collector has the right to collect on it. You can request verification of a debt by sending?a debt validation letter, in case your preliminary contact with the collector was inside 30 days prior to now. A debt collector who can’t affirm your debt with?ample proof can’t collect from you, that options itemizing the debt in your credit score rating report. Nonetheless, if the debt collector does have and provides you with proof, assortment train can resume.

- It is perhaps larger to simply wait until the credit score rating reporting time prohibit has expired for cash owed that are close to the seven 12 months mark. As quickly because the merchandise robotically falls off your credit score rating report it is not going to impression your credit score rating score.

- Ship the pay for delete?letter offered that you just probably can?pay the entire amount as quickly as your present is accepted. It is potential you will solely have a positive time to pay sooner than the present is rescinded and assortment actions resume.

- Ship the letter and your follow-up value by means of licensed mail with return receipt requested. This offers you proof that?the letter and your value had been mailed and purchased.

- Make sure you make a replica of the letter for?your data or in case it’s worthwhile to try the method with a definite creditor or collector.

What If the Pay for Delete Present Is Rejected?

Sadly, there is no guarantee the pay for delete present will seemingly be accepted. The pay for delete present is solely a request.

Observe

Whereas your present to pay the account in full is often incentive for the creditor/collector to switch your credit score rating report,?the creditor/collector should not be obligated to easily settle for your present.

In case your present is rejected, you probably can:

- Pay in full anyway; a zero stability is more healthy than a wonderful stability.

- Settle the account for decrease than the entire stability due; you’ll should make a settlement present and have it accepted by the creditor or collector.

- Wait until the account is moved to a unique collector (this usually happens every six months, nonetheless usually by no means) and make a model new pay for delete or settlement present.

- Pay nothing and wait until the credit score rating reporting prohibit expires and the merchandise falls off your credit score rating report. Observe that assortment efforts will proceed (you probably can stop third-party collector calls with a cease and desist letter) and you may be sued for the debt.

Repeatedly Requested Questions (FAQs)

What is the statute of limitations on debt collections?

Debt doesn’t expire until it is paid in full. Which means there is no prohibit on how prolonged assortment actions can occur. There is a prohibit to how prolonged you is perhaps sued for debt, however. That’s the statute of limitations and it varies by state. Often, it ranges from three to six years. Once you’re sued for a debt which can be exterior the statute of limitations in your state, the right plan of motion is to hunt the recommendation of an authorized skilled for assist.

How do you uncover out which assortment firm has your debt?

You’ll have only a few selections to look out out which assortment firm owns your debt. You may ask your distinctive creditor, nonetheless that data may not be appropriate if it has been provided a variety of situations. It is also potential to get a free copy of your credit score rating report and see the best way it is listed there. The info might probably be out-of-date, though, significantly within the occasion you are debt has simply recently been purchased. Many assortment companies title, so that you may moreover study your voicemail or unknown phone numbers which have often called.